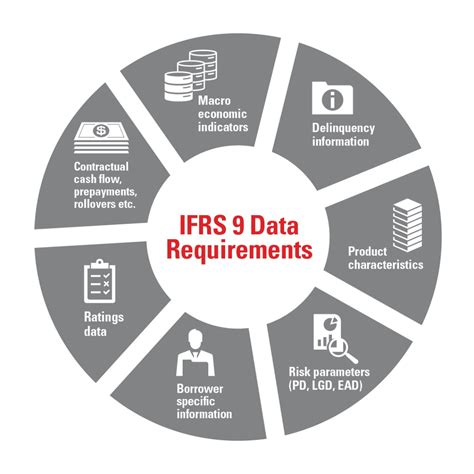

ifrs 9 euler hermes | IFRS 9 accounting model ifrs 9 euler hermes What is IFRS9? The new IFRS9, effective from January 2018, establishes a new . Located in Il-Furjana, 23 Boutique Hotel provides air-conditioned rooms with free WiFi. The property is around 1.8 miles from Rock Beach, a 17-minute walk from University of Malta – Valletta Campus and 2.5 miles from University of Malta. Hal Saflieni Hypogeum is 2.8 miles away and The Point Shopping Mall is 3.3 miles from the hotel.

0 · what is IFRS 9

1 · IFRS 9 hedging instruments

2 · IFRS 9 hedge accounting

3 · IFRS 9 financial statements

4 · IFRS 9 financial instruments

5 · IFRS 9 ecl

6 · IFRS 9 accounting requirements

7 · IFRS 9 accounting model

The Three Cities of Malta, Vittoriosa (Birgu), Senglea (Isla), and Cospicua (Bormla) are a unique showcase of Malta’s rich history and cultural heritage. These towns are historic fortified places that played a significant role in defending Malta, particularly during the Great Siege of 1565.

requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis .

patek philippe sa founded

By using its credit risk models, Bank A determines that the exposure at default on the credit .IFRS 9 has three classification categories for debt instruments: amortised cost, fair value . What is IFRS9? The new IFRS9, effective from January 2018, establishes a new .

what is IFRS 9

This Executive Summary provides an overview of the ECL framework under .This example illustrates the accounting requirements for the reclassification of financial assets .

Euler Hermes Switzerland offers companies professional assessments of default .Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the . This newsletter provides a high-level overview of the IFRS 9 requirements, .requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities;

IFRS 9 hedging instruments

IFRS 9 hedge accounting

IFRS 9 has three classification categories for debt instruments: amortised cost, fair value through other comprehensive income (‘FVOCI’) and fair value through profit or loss (‘FVPL’).

What is IFRS9? The new IFRS9, effective from January 2018, establishes a new model to calculate provisions for credit losses: the so-called “expected credit losses“ (ECL) model.

IFRS 9 'Financial Instruments' issued on 24 July 2014 is the IASB's replacement of IAS 39 'Financial Instruments: Recognition and Measurement'. The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge accounting.

This Executive Summary provides an overview of the ECL framework under IFRS 9 and its impact on the regulatory treatment of accounting provisions in the Basel capital framework.By using its credit risk models, Bank A determines that the exposure at default on the credit card facilities for which lifetime expected credit losses should be recognized is CU25,000 (that is, the drawn balance of CU20,000 plus further draw-downs of .This example illustrates the accounting requirements for the reclassification of financial assets between measurement categories in accordance with Section 5.6 of IFRS 9. The example illustrates the interaction with the impairment requirements in Section 5.5 of IFRS 9.Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs.

Euler Hermes Switzerland offers companies professional assessments of default risks in accordance with the requirements of IFRS 9-Financial Instruments. The constant calculation models can also be used uniformly for internationally structured groups. This newsletter provides a high-level overview of the IFRS 9 requirements, focusing on the areas which are different from IAS 39, including: classification and measurement of financial assets; impairment; classification and measurement of financial liabilities; and. hedge accounting. Download.

requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities;IFRS 9 has three classification categories for debt instruments: amortised cost, fair value through other comprehensive income (‘FVOCI’) and fair value through profit or loss (‘FVPL’).

What is IFRS9? The new IFRS9, effective from January 2018, establishes a new model to calculate provisions for credit losses: the so-called “expected credit losses“ (ECL) model.IFRS 9 'Financial Instruments' issued on 24 July 2014 is the IASB's replacement of IAS 39 'Financial Instruments: Recognition and Measurement'. The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge accounting. This Executive Summary provides an overview of the ECL framework under IFRS 9 and its impact on the regulatory treatment of accounting provisions in the Basel capital framework.

By using its credit risk models, Bank A determines that the exposure at default on the credit card facilities for which lifetime expected credit losses should be recognized is CU25,000 (that is, the drawn balance of CU20,000 plus further draw-downs of .

IFRS 9 financial statements

This example illustrates the accounting requirements for the reclassification of financial assets between measurement categories in accordance with Section 5.6 of IFRS 9. The example illustrates the interaction with the impairment requirements in Section 5.5 of IFRS 9.Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs. Euler Hermes Switzerland offers companies professional assessments of default risks in accordance with the requirements of IFRS 9-Financial Instruments. The constant calculation models can also be used uniformly for internationally structured groups.

IFRS 9 financial instruments

Chanel Boy Bag Serial Number. To the left of the interior label is where you’ll find the hologram tab with the bag’s unique serial number. Cross-referencing the serial number and date of production helps to determine authenticity. The first two digits of the serial number correspond to the bag’s production year.

ifrs 9 euler hermes|IFRS 9 accounting model